All Categories

Featured

Table of Contents

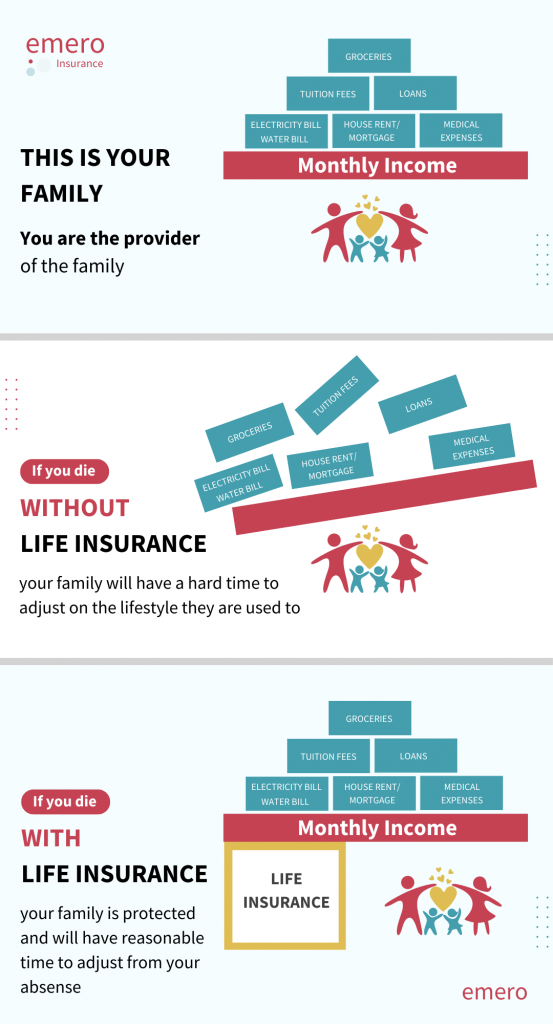

Term life insurance policy might be much better than mortgage life insurance as it can cover mortgages and other expenses. Contrast life insurance coverage online in minutes with Everyday Life Insurance Policy. Mortgage life insurance policy, additionally called, home mortgage defense insurance policy, is marketed to home owners as a method to pay off their home loan in situation of death.

It appears great, it might be much better to obtain a term life policy with a large fatality advantage that can cover your mortgage for your beneficiary. Home mortgage life insurance coverage pays the remainder of your mortgage if you pass away during your term. "Home mortgage protection insurance is a means to speak about insurance coverage without mentioning dying," states Mark Williams, Chief Executive Officer of Brokers International.

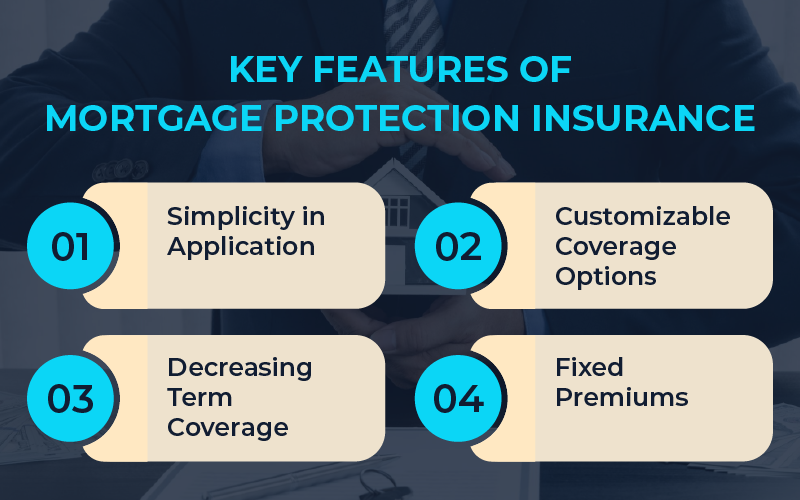

Unlike a conventional term life insurance coverage policy that has the very same costs, it's rates and the death advantage normally decrease as your mortgage lowers. This insurance coverage is frequently perplexed with private home loan insurance coverage, but they are very various principles. home protection insurance plan. If you have a mortgage and your deposit is much less than the typical 20%, your loan provider will call for mortgage insurance coverage to safeguard them in case you fail on your home loan payments

Williams claimed a person can name a spouse as the recipient on a mortgage security insurance plan. The partner will certainly obtain the cash and can pick whether to pay off the home loan or market your house. If an individual has home loan life insurance policy and a term life plan with the spouse as the recipient on both, then it can be a double windfall.

Decreasing term insurance coverage is the much more usual kind of home mortgage life insurance coverage. With this policy, your insurance costs and protections decrease as your mortgage amount lowers. Degree term insurance supplies a set survivor benefit via the period of your home loan. This type of home loan life insurance would be appropriate for an insurance holder with an interest-only home mortgage where the borrower only pays the rate of interest for a certain period of time.

Mortgage Insurance Policies Quotes

Home mortgage life insurance policy additionally needs no medical examinations or waiting periods. If you pass away with a superior home mortgage, mortgage life insurance policy pays the remainder of the finance directly to the loan provider. In turn, your loved ones don't have to manage the financial concern of paying off the home mortgage alone and can concentrate on grieving your loss.

Your mortgage life insurance policy policy is based on your home mortgage car loan amount, so the information will differ relying on the expense of your mortgage. Its prices reduce as your home loan decreases, yet premiums are generally much more expensive than a standard term life plan - mortgage payment protection insurance us. When selecting your fatality benefit quantity for term life insurance coverage, the guideline is to select 10 times your yearly income to cover the mortgage, education for dependents, and various other expenses if you pass away

Your home mortgage life insurance policy terminates when your home mortgage is settled. If you settle your mortgage prior to you die, you'll be left without a fatality benefitunless you have other life insurance policy. Unlike term life insurance policy, permanent life insurance policy deals lifelong coverage. It additionally comes with a money value element, where a part of your costs is saved or spent, increasing your policy's worth.

Insurance That Pays Off Mortgage

Both most typical irreversible life insurance policy policies are whole life and global life insurance. With a whole life policy, you pay a set premium for a guaranteed survivor benefit. The policy's cash money worth additionally grows at a set rate of interest. On the other hand, a global life policy allows you to readjust when and just how much you pay in costs, subsequently changing your insurance coverage.

Home loan life insurance policy may be an excellent choice for house owners with health problems, as this coverage provides instant coverage without the demand for a clinical exam. Typical life insurance policy might be the finest choice for a lot of people as it can cover your home mortgage and your other financial responsibilities. Plus, it tends to be cheaper.

However, you can likewise call various other recipients, such as your spouse or youngsters, and they'll receive the survivor benefit. With decreasing term insurance coverage, your protection decreases as your mortgage reduces. With degree term insurance, your coverage quantity stays the same throughout the term. No, lending institutions do not call for home mortgage life insurance policy.

Mortgage Protection Insurance If You Lose Your Job

One perk of mortgage life insurance policy over a traditional term plan is that it typically does not call for a medical test - life insurance and protection plan. Ronda Lee is an insurance coverage expert covering life, automobile, home owners, and tenants insurance coverage for consumers.

ExperienceAlani is a former insurance other on the Personal Financing Expert team. She's evaluated life insurance coverage and family pet insurance policy companies and has created various explainers on traveling insurance, debt, financial debt, and home insurance. She is passionate about debunking the complexities of insurance and other individual financing topics to make sure that visitors have the information they need to make the best money choices.

When you obtain a mortgage to buy your home, you will generally require to take out home loan protection insurance. This is a specific type of life assurance that is taken out for the term of the home mortgage.

Mortgage Payoff Life Insurance

If you pass away without home mortgage insurance policy protection, there will be no insurance coverage to pay off the mortgage. This indicates that the joint proprietor or your recipients will have to proceed paying off the home loan. The need to secure mortgage protection and the exceptions to this are set-out in Section 126 of the Customer Credit History Act 1995.

For instance, you can get: Reducing term cover: The amount that this plan covers decreases as you pay off your mortgage and the plan ends when the home mortgage is settled. Your premium does not change, although the degree of cover minimizes. This is the most typical and cheapest type of home loan defense.

If you pass away prior to your home mortgage is paid off, the insurance coverage company will certainly pay out the initial quantity you were insured for. This will pay off the home mortgage and any type of remaining balance will certainly go to your estate.: You can add serious illness cover to your home mortgage insurance coverage policy. This indicates your home mortgage will certainly be settled if you are detected with and recoup from a major health problem that is covered by your plan.

This is much more expensive than various other types of cover. Life insurance coverage cover: You can make use of an existing life insurance coverage plan as home mortgage security insurance policy. You can just do this if the life insurance policy policy provides adequate cover and is not designated to cover an additional funding or home mortgage. Home loan repayment security insurance policy is a sort of repayment defense insurance.

Mortgage Ppi Quote

This kind of insurance policy is generally optional and will commonly cover repayments for twelve month - property insurance mortgage. You need to get in touch with your mortgage lender, insurance policy broker or insurance provider if you are unsure concerning whether you have mortgage payment security insurance. You should also examine precisely what it covers and make certain that it fits your circumstance

With a home loan life insurance plan, your recipient is your home loan loan provider. This indicates that the cash from the advantage payment goes directly to your mortgage lender.

Group Mortgage Protection Insurance

Taking out a home loan is among the greatest responsibilities that adults face. Falling back on mortgage settlements can result in paying even more interest costs, late costs, foreclosure process and even losing your residence. Home loan protection insurance (MPI) is one way to guard your household and financial investment in situation the unthinkable happens.

It is specifically beneficial to individuals with expensive mortgages that their dependents couldn't cover if they passed away. The essential difference between home loan protection insurance coverage (MPI) and life insurance coverage lies in their protection and versatility. MPI is particularly designed to settle your home loan balance straight to the lender if you pass away, while life insurance coverage offers a broader fatality advantage that your recipients can utilize for any kind of economic needs, such as home loan repayments, living costs, and financial obligation.

Latest Posts

Life Insurance For Funeral Costs

Sell Final Expense By Phone

Senior Life Final Expense Insurance